pinellas county sales tax calculator

2020 rates included for use while preparing your income tax deduction. This is the total of state and county sales tax rates.

The Florida state sales tax rate is currently.

. The Pinellas County sales tax rate is. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. General Tax Administration Program.

The current total local sales tax rate in Pinellas County FL is 7000. JustMarket Value limited by the Save Our Homes Cap or 10 Cap Assessed Value. If you live in Miami-Dade County or Pinellas County you pay 1 county sales tax on the first 5000 of your vehicle purchase which adds 50 if your car costs 5000 making the state and county sales tax total 350.

Nearby food drink options include Kimmy Ds 49th Street Cafe Quaker Steak Lube and McDonalds. Certificate holders use Lienhub to run estimates and make application for tax deed. The estimated cost to register and title a vehicle for the first time is 42000 plus any sales tax due.

The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales tax. The sales tax rate for Pinellas County was updated for the 2020 tax year this is the current sales tax rate we are using in the Pinellas County Florida Sales Tax Comparison Calculator for 202223. So lets discuss the specifics The best place to start is Florida Rule 12A-150043 Florida Administrative Code FAC which provides the guidance for retailers to determine when and how to apply the discretionary.

The state of Florida imposes 6 sales tax on the full purchase price less trade-in. Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas County totaling 1. Clerks Official Records conducts the sale of Tax Deeds in Pinellas County upon notification from the Pinellas County Tax Collector.

This is the total of state county and city sales tax rates. You can find more tax rates and allowances for Pinellas County and Florida in the 2022 Florida Tax Tables. The 2018 United States Supreme Court decision in South Dakota v.

How to Calculate FL Sales Tax on Rent published April 11 2019 by Michael Moffa Esq. The total sales tax rate in any given location can be broken down into state county city and special district rates. The sales are held in accordance with Florida Statutes Chapter 197 and Florida Administrative Code Chapter 12D-13.

The December 2020 total local sales tax rate was also 7000. Florida Sales Tax Informal Written Protest published November 17 2018 by James Sutton CPA Esq. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Pinellas County. Pinellas County has one of the highest median property taxes in the United States and is ranked 640th of the 3143 counties in order of median property taxes. This rate includes any state county city and local sales taxes.

This table shows the total sales tax rates for all cities and towns in Pinellas. Florida has a 6 sales tax and Pinellas County collects an additional 1 so the minimum sales tax rate in Pinellas County is 7 not including any city or special district taxes. The latest sales tax rate for Gulfport FL.

For Tax Certificate Sales please visit the Pinellas County Tax Collector. The Pinellas Park sales tax rate is 0. Whether you are already a resident or just considering moving to Pinellas County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Assessed Value - Exemptions Taxable Value. Protest a FL Sales and Use Tax Audit published August 8.

The total sales tax rate in any given location can be broken down into state county city and special district rates. If this rate has been updated locally please contact us and we will update the sales tax rate for Pinellas County Florida. Did South Dakota v.

All applications for title must be signed with the applicants full name. Learn all about Pinellas County real estate tax. The Pinellas County Sales Tax is collected by the merchant on all qualifying sales made within Pinellas County.

The Florida sales tax rate is currently 6. The minimum combined 2022 sales tax rate for Pinellas Park Florida is 7. This table shows the total sales tax rates for all cities and towns in Pinellas County.

Pinellas County collects on average 091 of a propertys assessed fair market value as property tax. But for a high-volume retailer even small tax discrepancies can add up in the typical 3-year sales tax audit. General Tax Administration Program.

Groceries are exempt from the Pinellas County and Florida state sales taxes. Pinellas County residents pay an additional 1 on the first 5000. Popular points of interest near 5410 Palm Crest Ct N 1 include Kimmy Ds 49th Street Cafe Pinellas Park Fire Department and Pinellas Park Fire Department.

The minimum combined 2022 sales tax rate for Pinellas County Florida is. Puerto Rico has a 105 sales tax and Pinellas County collects an additional 1 so the minimum sales tax rate in Pinellas County is 7 not including any city or special district taxes. Taxable Value x Millage Rate 1000 Gross taxes On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000.

Actual property tax assessments depend on a number of variables. The median property tax in Pinellas County Florida is 1699 per year for a home worth the median value of 185700. Nearby grocery stores include Aldi Bolsa Market and Schwan Sales.

The median property tax on a 18570000 house is 194985 in the United States. How to Calculate Collect and Report Your Discretionary Sales Surtax. 3 Oversee property tax administration.

The County sales tax rate is 1.

Pasco County Fl Property Tax Search And Records Propertyshark

33766 Sales Tax Rate Fl Sales Taxes By Zip

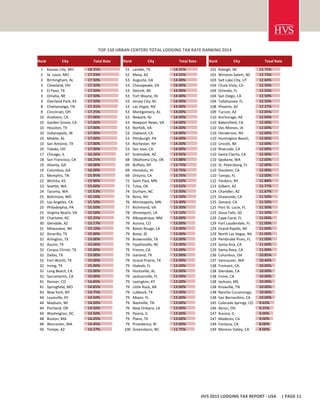

Hvs 2015 Hvs Lodging Tax Report Usa

Hillsborough Pinellas Median Home Prices 2021 Statista

2015 Florida Hotel Tax Rates By County

2015 Florida Hotel Tax Rates By County

Charts Graphs Robertlathamesq Org

2015 Florida Hotel Tax Rates By County

Ces Received A Wonderful Letter From The Pinellas County Public Defender Bob Dillinger Thank You For Your Letter And For Recognizi Solutions Energy Lettering